Candlestick Technical Analysis : An Introduction

The Japanese candlestick, hereafter simply referred to as candlestick or candle, is a very effective way to convey the open, high, low, close price points for the period in question, which may be minute, hour, day, week, etc. as supported by the charting software.

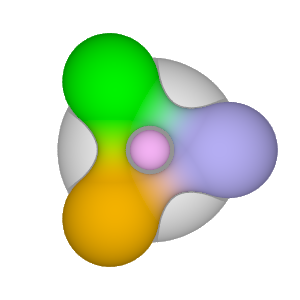

The body of the candlestick is defined by the open and close prices. The tails of the candlestick (some call them wicks or shadows) indicate the high and low prices. A color or shading convention is used for the body of the candlestick to convey the up/down direction of the candlestick. An up candle has the closing price higher than the opening price. A down candle has the closing price lower than the opening price. Colors used for the body include red and blue for down candles; green and white for up candles – subject to the convention used in the charting software which may allow user customization.

Visually, candlestick charting is very effective in conveying the up and down periodic movements of the stock price. At a glance, the user is able to see whether a stock closed higher than its opening price (up candle), or vice versa, a stock closed lower than its opening price (down candle). The length of the body as well as the tails show the range of price movement for the stock. And the user is able to follow the progression of candlesticks in successive periods.

There are various candlestick patterns such as doji and hammer (just to cite two from the long list of patterns which may span 1, 2, 3 or even more periods) that are used in candlestick technical analysis where significant conclusions are attached to each pattern.

More you might like

What Do Candlestick Patterns Indicate?

This article covers what candlestick patterns indicate as it applies to trading decisions.

From Long-Term Investing to Short-Term Trading – How to Profit on the Stock Price Rise and Drop

This article presents the notion of migrating from a long-term buy-and-hold investing strategy to a short-term profit-making trading style, capitalizing on the rise and drop of the stock price (following the trend and profiting on the cycles).

Impact of Personality Influences on Stock Trading

This article examines the impact of personality influences on stock trading activities and what can be done to control such influences on stock trading.

Trading on Support and Resistance plus Trend Reversals

This article examines the technical analysis indicators for support and resistance and trend reversals. Knowing how to identify and apply these will translate into a valuable tool for your trading success.

Comparing Day Trading with Other Trading Timeframes (March/2009)

This article covers my day trading experiences in the month of March/2009. Different trading timeframes are compared.